According to Crunchbase News, total global venture capital in the third quarter of 2022 was $81 billion, down $90 billion (53%) year-over-year and $40 billion (33%) quarter-on-quarter. Southeast Asia’s market attracted 3.72 billion USD in the third quarter of 2022, down 36.4% over the same period last year and down 22% compared to the previous quarter.

Although the total investment value has decreased, the Southeast Asian market is projected to be potential. A large market size of 680 million people, and the growth in the number of internet users, bring the total number of internet users to 460 million.

Mr. Vinnie Lauria, founder and CEO of Golden Gate Ventures said, “a recent study by this investment fund shows that global investment flows are moving into Asia, specifically the “golden triangle” of startups in Southeast Asia including Vietnam, Indonesia, and Singapore. For example, investment from the Gulf into ASEAN increased by more than 500% last year compared to the previous five years combined.”

Vietnam is a bright spot to attract venture capital.

Vietnam has been participating in the “Golden Triangle of Southeast Asian Startups” by providing a young, vibrant domestic market with excellent tech talent and constant innovation.

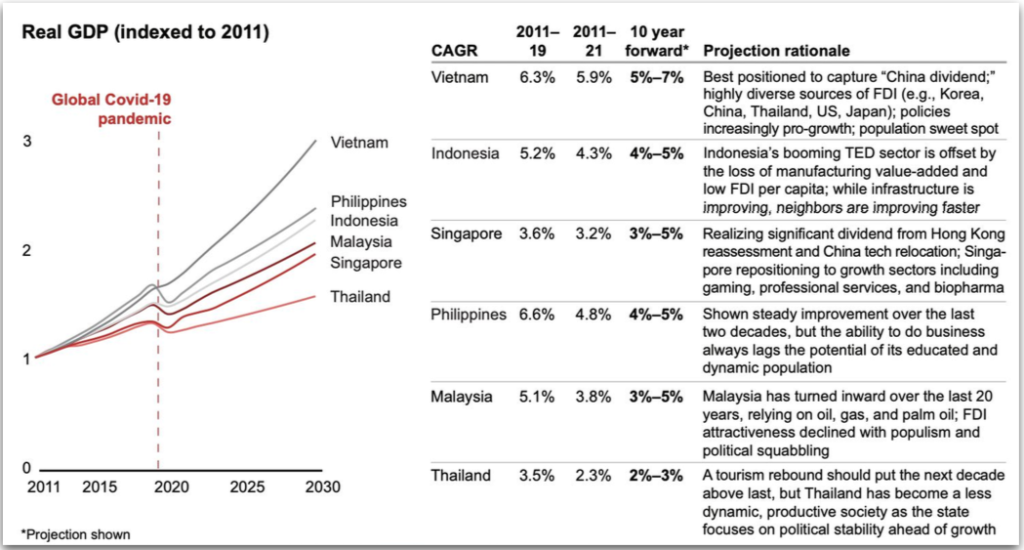

The IMF also recently forecasted that ASEAN is the only region globally with any forecasted GDP growth over the next two years, in which Vietnam and Indonesia will lead the growth of ASEAN and be the driving force for global growth in the next two years.

The Golden Gate Ventures CEO also said that over the past decade, Vietnam has grown at an average annual rate of about 7%, largely thanks to the expanding technology and innovation sector. In the fact that Vietnam’s tech industry has grown at an annual rate of 20% over the past decade, making Vietnam one of the fastest-growing technology markets in the world.

Our research also highlights that on the current trajectory, Vietnam’s GDP per capita is expected to surpass that of Indonesia within the next five years. That’s very exciting for investors and a foreshadowing that the investors come from global VCs with a tradition of operating in other Asian markets like China, India, and Indonesia will start looking to Vietnam,” emphasized Mr. Vinnie Lauria.

Quote from Doanhnhantrevietnam