With a population of nearly 100 million and a predominantly young demographic, Vietnam boasts a captivating education market. Despite English not being widely used as a second language, the demand for learning English in Vietnam is substantial. This is primarily because a significant portion of the population is under 35, and the overall English proficiency level remains modest. Consequently, bolstering foreign language skills is deemed a paramount priority in Vietnam’s education sector, opening the door to opportunities for developing the EdTech market, especially in English language learning applications.

According to the Director of Marketing at Duolingo for China and Southeast Asia, Vietnam stands as their most prominent and fastest-growing market within the ASEAN region. Over 12 months, their application has garnered the attention of 2.2 million users in Vietnam. These users span a broad age group, ranging from 15 to 45 years, encompassing both students and office professionals.

In Vietnam, there are a total of 1,917 officially licensed language training centers in Hanoi and Ho Chi Minh City, without accounting for online and informal group-based instruction, teachers offer private tutoring, and English clubs thrive within schools, etc. Additionally, over 40% of students opt for self-directed learning.

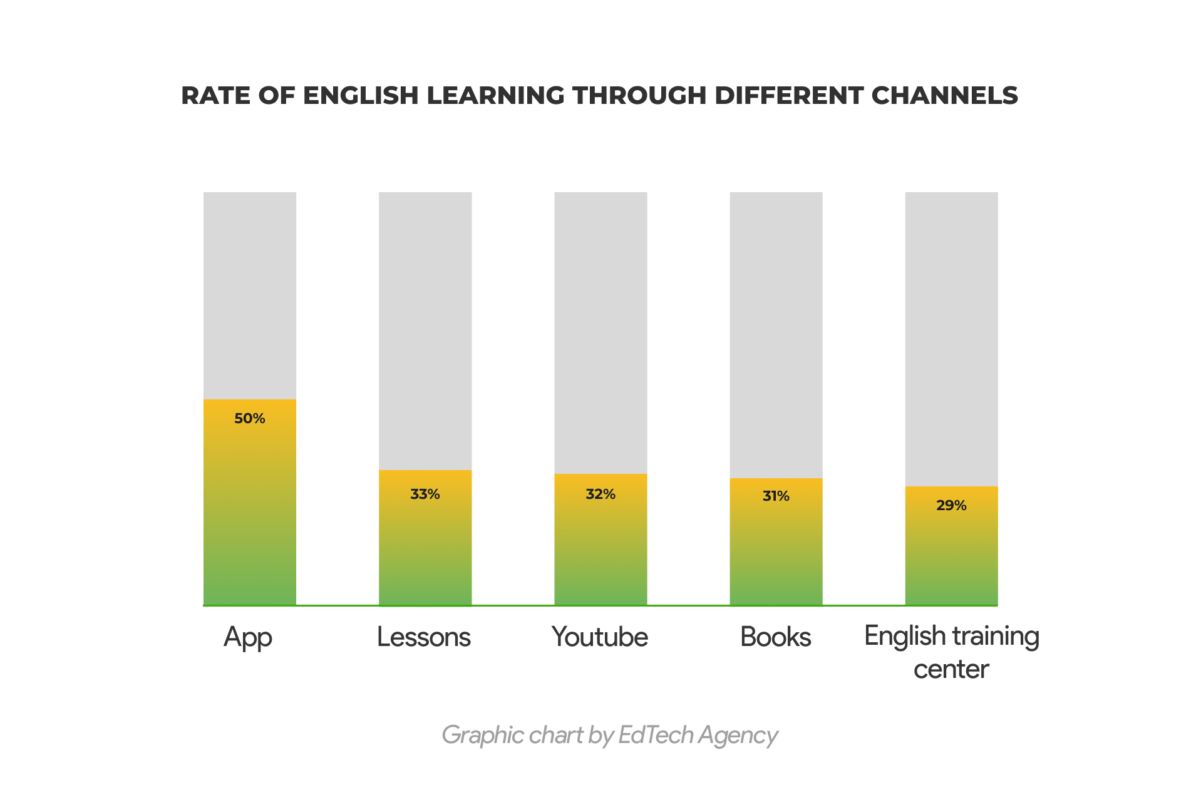

Statistical findings reveal that most learners primarily utilize mobile apps at 50%, followed by online learning through lessons at 33%. Other avenues for learning include YouTube, books, and language centers, comprising 32%, 31%, and 29%, respectively. After two years of education being influenced by the COVID-19 pandemic, online English learning has emerged as the preferred solution for both students and adults, owing to its safety and the absence of geographical and time constraints.

The current English learning market segments in Vietnam can be delineated as follows:

– Age-based segments: Preschool, K-12, Higher Education, Vocational Training

– Methodology of instruction: Offline, Online, Apps

Among these segments, K-12 education and vocational training are particularly dynamic. Currently, only 58% of students attain a B1 proficiency level in English, with a mere 5% reaching B2, which signifies effective communication with foreigners. Vietnam has an approximate student population of 2 million, with about 250,000 graduates annually. However, merely 50% of these students meet the standards for graduation with a proficiency level of B1 or higher.

Some language learning applications align with the national education program, while others concentrate on listening and speaking skills. Specific applications are geared toward preparing students for international certifications such as TOEFL and IELTS. These applications offer subscription options based on an annual or lifetime access basis, with pricing tailored to the income levels of Vietnamese citizens, ranging from 1-6 million VND.

Present-day language learning applications increasingly integrate AI technologies to enhance learning efficiency and engage learners. Tuition fees are contingent on the technological advancement, flexibility, and quality of study materials provided by these applications. AI technologies encompass curriculum development, voice recognition, AI-driven communication practice, virtual assistants, and more.

The estimated total market for foreign language training in Vietnam currently encompasses around 700 million individuals ages 3 to 40. There is also a notable demand for retraining or acquiring a second foreign language for professional purposes. The financial reports of several foreign enterprises investing in the English language training market in Vietnam reveal sustained robust growth. Myanmar Strategic Holdings (MSH), a multi-industry conglomerate, acquired Wall Street English (WSE Vietnam), a language training system in Ho Chi Minh City, in July 2020. By March 2021, MSH reported a remarkable 175% surge in revenue compared to the previous year, with 65% of this increase attributed to the education sector. MSH further expounded that this significant revenue growth was mainly due to the contribution of WSE Vietnam.

Investment in English language education in Vietnam, while not necessitating substantial capital, garners high esteem from experts and investors alike. Capital flows from both domestic and international enterprises into this market continue to demonstrate no signs of abating. However, this heightened interest also ushers in increasingly intense competition, necessitating comprehensive investments, the deployment of advanced technology, and the substantiation of genuine value by delivering tangible improvements for learners.

The end

_________

At Edtech Agency, we assist our clients in market analysis and provide in-depth reports on various market segments, aiding our clients in making well-informed investment decisions within the Vietnamese market.

Edtech Agency also takes the lead in connecting clients with potential partners in the Vietnamese market and executing market trial projects, gathering feedback to inform investment decisions.

Contact Edtech Agency today for a consultation.